Introduction:

Dealing with student loan debt has long been a challenge for many borrowers. However, recent developments in the realm of bankruptcy law have brought some hopeful news. The U.S. Justice Department has introduced a new procedure, known as the attestation process, that offers the potential for discharging Federal student loans in bankruptcy. In this article, we’ll explore what this new process entails and how it can impact those struggling with student loan debt.

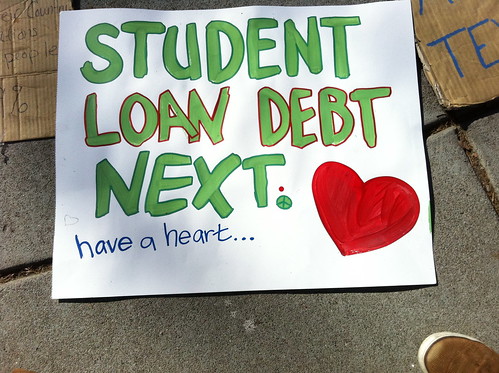

The Student Loan Debt Challenge:

Student loan debt has been a financial burden for millions of Americans. In the past, discharging these loans through bankruptcy was a complex and often insurmountable process due to stringent legal standards. However, the attestation process presents a potential game-changer.

The Attestation Process Explained:

The Justice Department’s attestation process simplifies the path to discharging Federal student loans in bankruptcy. Here’s how it works:

- Eligibility Assessment: To begin, individuals seeking to discharge their Federal student loans in bankruptcy must meet certain eligibility criteria. The new procedure typically applies to borrowers facing undue hardship and those who can demonstrate an inability to maintain a minimal standard of living.

- Attestation Submission: If eligible, the borrower can submit this attestation to the court. The attestation is a sworn statement explaining the borrower’s financial situation and the reasons for seeking student loan discharge.

- Court Review: The bankruptcy court reviews the attestation and assesses whether the borrower meets the required criteria. The court considers factors such as the borrower’s income, expenses, and other financial obligations.

- Discharge Decision: Based on the court’s assessment, a decision is made regarding the discharge of the Federal student loans. If granted, the loans are discharged, providing the borrower with a fresh start.

Key Benefits of the Attestation Process:

The introduction of the attestation process brings several notable benefits to borrowers struggling with Federal student loan debt:

- Simplified Procedure: Unlike the previous, often convoluted process, the attestation procedure simplifies the steps for those seeking student loan discharge in bankruptcy.

- Undue Hardship Focus: The attestation process centers on assessing whether a borrower faces undue hardship due to their student loan debt, making it more accessible for those in genuine need.

- Potential for Debt Relief: For eligible borrowers, the attestation process can offer the chance to discharge Federal student loans, providing significant financial relief.

Consulting a Bankruptcy Attorney:

Navigating the attestation process for discharging Federal student loans in bankruptcy is not without its challenges. It’s crucial to consult with an experienced bankruptcy attorney to assess your eligibility, prepare a convincing attestation, and guide you through the legal proceedings. They can help you understand your options, gather the necessary documentation, and ensure you have the best chance of success.

Conclusion:

The Justice Department’s attestation process has the potential to be a ray of hope for those burdened by Federal student loan debt. While it simplifies the path to discharging these loans, it is essential to approach the process with care and under the guidance of a legal professional. If you’re struggling with Federal student loans and are considering bankruptcy as a solution, this new procedure may offer the relief you’ve been seeking.